Boosting California’s Tomato Industry with Aloecoat: A Sustainable Post-Harvest Solution

California reigns as the epicenter of U.S. tomato production, supplying over 90% of the nation’s processing tomatoes and a significant share of fresh-market tomatoes, with an industry valued at approximately $1.3 billion in 2023.

Thriving in the fertile Central Valley and other key regions, the state’s tomato sector faces challenges like post-harvest spoilage, environmental pressures, and operational inefficiencies, contributing to substantial fruit waste.

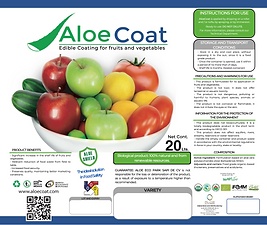

Aloecoat, a 100% natural, plant-based edible coating derived from aloe vera, offers a transformative post-harvest solution to reduce waste, extend shelf life, and optimize operations.

This article explores the key characteristics of California’s tomato production, leveraging the latest 2023–2024 data, and demonstrates how Aloecoat can elevate the industry’s sustainability and profitability.

Characteristics of Tomato Production in California

- Economic Significance and Production Volume

In 2023, California produced 12.8 million short tons of processing tomatoes across 254,000 contracted acres, a 21.4% increase from 2022’s 10.5 million tons, valued at roughly $1.3 billion. For 2024, contracted production was forecast at 11.3 million tons across 226,000 acres, a 12% decrease from 2023 due to reduced acreage and high summer temperatures. Fresno County led with 53,400 acres in 2024, followed by Yolo (30,500 acres), Kings (18,800 acres), Madera (5,200 acres), and Tulare (2,100 acres), accounting for 65% of the state’s contracted acreage. Fresh-market tomatoes, while smaller in volume, contribute significantly, with California supplying nearly a third of U.S. fresh tomatoes, primarily from San Diego, Imperial, and Riverside counties. - Regional and Seasonal Dynamics

California’s tomato production is concentrated in the Central Valley (Fresno, Kings, Merced, Yolo, San Joaquin counties) for processing tomatoes, with fresh-market tomatoes grown in southern regions like San Diego and Imperial. The growing season begins with planting in late February to early March, facilitated by mild spring temperatures, and harvest runs from late June to October. In 2024, favorable spring conditions supported planting, but mid-season heatwaves reduced yields, with harvests concluding earlier than in 2023. - Climatic and Soil Requirements

Tomatoes thrive in California’s Mediterranean climate, with warm, dry summers (70–90°F) and well-drained, fertile loamy soils rich in organic matter. Drip irrigation and soil moisture monitoring are critical, especially amid ongoing drought concerns. In 2024, reservoirs were at 120% of historical levels early in the season, but low precipitation and a potential La Niña raised water allocation concerns, with the State Water Project at 10% as of December 2023. These conditions underscore the need for water-efficient practices to sustain yields. - Post-Harvest Challenges

Post-harvest losses, estimated at 20–30% for fresh tomatoes and 5–10% for processing tomatoes, pose significant challenges. Key issues include:- Microbial Spoilage: Fungal pathogens like Botrytis cinerea (gray mold) and bacterial soft rot cause decay during storage and transport, particularly under high humidity (85–95% RH).

- Moisture Loss: Fresh tomatoes lose firmness and quality due to water loss, with thresholds as low as 3–5% causing shriveling and reduced marketability.

- Physical Damage: Bruising and cracking from rough handling or over-maturity reduce quality, especially for fresh-market tomatoes.

- Physiological Disorders: Blossom-end rot and sunscald, linked to calcium deficiencies or heat stress, affect appearance and shelf life.

These challenges necessitate rapid cooling (0–13°C for fresh tomatoes, depending on ripeness), controlled atmosphere storage, and careful handling, yet inefficiencies persist, driving up waste and costs.

- Environmental and Regulatory Pressures

Climate change, including heatwaves, droughts, and wildfires, threatens tomato production. In 2024, high summer temperatures reduced yields, while water scarcity remains a concern despite reservoir levels. Regulatory costs, including pesticide restrictions, have risen, with compliance expenses increasing 63.7% from 2017 to 2024. The Beet Curly Top Virus and parasitic weeds like broomrape also pose risks, though minimal damage was reported in 2023 due to wet conditions and improved pest management. The industry is adopting sustainable practices, such as drip irrigation and organic farming, to meet environmental standards and consumer demand. - Labor and Operational Dynamics

Tomato production is labor-intensive, particularly for fresh-market tomatoes, which require manual harvesting and packing. Processing tomatoes benefit from mechanized harvesting, reducing labor dependency. Post-harvest operations, including sorting, cooling, and transport, demand precision to minimize damage. In 2024, processors aimed to maintain efficient factory run rates despite lower contracted tonnage, highlighting the need for streamlined operations to offset reduced acreage and rising costs.

Aloecoat: Transforming Post-Harvest Tomato Management

Aloecoat, a biodegradable, edible coating made from aloe vera’s polysaccharides, enzymes, and bioactive compounds, forms a protective biofilm on tomatoes, reducing respiration, moisture loss, and microbial growth.

This innovative solution addresses California’s tomato industry challenges, enhancing sustainability and profitability.

Here’s how Aloecoat can make a difference:

- Reducing Post-Harvest Waste

- Moisture Retention: Aloecoat’s polysaccharide-based coating minimizes water loss, preserving tomato firmness and preventing shriveling, especially for fresh-market varieties. This reduces losses from quality degradation, maintaining marketability beyond the typical 2–3-week shelf life.

- Microbial Control: Aloe vera’s anthraquinones (e.g., aloin) provide natural antimicrobial properties, inhibiting pathogens like Botrytis cinerea and bacterial soft rot, reducing spoilage during storage and transport at 0–13°C.

- Physical Damage Protection: Aloecoat’s protective layer minimizes bruising and cracking from handling, preserving tomato integrity for both fresh and processing markets.

- Disorder Mitigation: By stabilizing cellular integrity and reducing ethylene production, Aloecoat helps prevent physiological disorders like blossom-end rot, ensuring premium quality.

- Extending Shelf Life

Aloecoat slows respiration rates (10–30 ml CO2/kg·hr at 13°C for fresh tomatoes) and ethylene production, extending shelf life under optimal storage conditions (0–13°C, 85–95% RH). This enables longer storage and transport periods, supporting California’s $1.3 billion tomato industry and its role in supplying domestic and international markets, with exports contributing to the state’s $22.4 billion agricultural export market in 2023. - Enhancing Sustainability

As a non-toxic, plant-based coating, Aloecoat aligns with California’s sustainability goals and consumer demand for clean-label products. It reduces reliance on synthetic chemical treatments, such as fungicides, and supports organic farming, which saw $11.8 billion in sales in 2023. By minimizing waste, Aloecoat enhances environmental stewardship and market competitiveness. - Improving Operational Efficiency

- Simplified Handling: Aloecoat’s application (via dipping or spraying) integrates seamlessly into existing packing lines, reducing labor-intensive sorting or trimming of damaged tomatoes.

- Cost Reduction: By minimizing waste (20–30% for fresh tomatoes), Aloecoat lowers losses from unsellable product and reduces equipment maintenance costs due to microbial buildup in storage systems.

- Market Advantage: High-quality, longer-lasting tomatoes strengthen California’s position in global markets, supporting the $1.3 billion industry and boosting grower profitability.

- Climate Resilience

Aloecoat mitigates climate-related challenges by protecting tomatoes from heat-induced quality degradation and environmental stressors. Its antioxidant properties, derived from aloe vera’s phenolic compounds, preserve flavor, texture, and nutritional value, ensuring premium quality despite heatwaves or drought, which impacted yields in 2024.

The Future of California’s Tomato Industry with Aloecoat

California’s tomato industry, valued at $1.3 billion in 2023, navigates a complex landscape of climate challenges, regulatory pressures, and post-harvest losses. Aloecoat offers a cutting-edge solution, leveraging aloe vera’s natural properties to reduce waste, extend shelf life, and enhance operational efficiency.

By integrating Aloecoat into post-harvest protocols, growers can address spoilage, meet consumer demand for sustainable products, and maintain California’s leadership in the global tomato market.

At aloegel.biz, we are dedicated to advancing sustainable agriculture with innovative aloe-based solutions.