Optimizing Arizona’s Lettuce Industry with Aloecoat: A Sustainable Post-Harvest Solution

Arizona is a powerhouse in U.S. lettuce production, ranking second only to California and supplying approximately 25% of the nation’s lettuce and leafy greens, with a production value of $934 million in 2023.

Known as the “Winter Lettuce Capital of the World,” Arizona’s Yuma County and surrounding regions play a critical role in feeding the nation from November to April. However, post-harvest challenges, such as spoilage, physiological disorders, and handling inefficiencies, contribute to waste rates as high as 45% for leafy greens.

Aloecoat, a 100% natural, plant-based edible coating derived from aloe vera, offers a transformative post-harvest solution to reduce lettuce waste, extend shelf life, and streamline industry operations.

This article explores the key characteristics of Arizona’s lettuce production, leveraging the latest 2023–2024 data, and demonstrates how Aloecoat can elevate sustainability and profitability.

Characteristics of Lettuce Production in Arizona

- Economic Significance and Production Volume

In 2023, Arizona harvested 68,500 acres of lettuce, a 5% increase from 65,000 acres in 2022, producing 22.06 million hundredweight (cwt) valued at $895.44 million. This included 30,200 acres of head lettuce, 13,400 acres of leaf lettuce, and 24,900 acres of romaine lettuce. In 2024, harvested acreage slightly decreased to 64,200 acres, comprising 26,800 acres of head lettuce (10.72 million cwt, $426.66 million), 11,400 acres of leaf lettuce (2.11 million cwt, $158.18 million), and 26,000 acres of romaine lettuce (8.71 million cwt, $349.27 million). Arizona accounts for 25.4% of U.S. head lettuce, 15.4% of leaf lettuce, and 18.1% of romaine lettuce production, with Yuma County leading as the state’s primary lettuce hub. - Regional and Seasonal Dynamics

Arizona’s lettuce production is concentrated in Western Arizona, particularly Yuma County, which accounts for 70–90% of national lettuce shipments from November to April. Central Arizona contributes a smaller share. The state’s winter growing season, with mild daytime temperatures (60–75°F) and cool nights (40–50°F), is ideal for lettuce, complementing California’s dominance from late April to mid-November. This seasonal shift ensures year-round U.S. lettuce supply, with Arizona’s “Arizona Leafy Greens Month” in November celebrating the start of the harvest season. In 2023, Arizona produced an estimated 9 billion servings of lettuce, contributing to over 100 billion servings since 2012. - Climatic and Soil Requirements

Lettuce thrives in Arizona’s well-drained, fertile sandy-loam soils with a pH of 6.0–7.0, supported by drip irrigation and soil moisture monitoring to combat the arid climate. In 2023, reservoir levels at 120% of historical averages provided water security, but 2024’s potential La Niña raised concerns about reduced precipitation and water allocations, with the State Water Project at 10% as of December 2023. Sustainable practices, such as precision irrigation, are critical to maintaining yields in this water-scarce region. - Post-Harvest Challenges

Post-harvest losses, reaching up to 45% for leafy greens, significantly impact Arizona’s lettuce industry. Key challenges include:- Microbial Spoilage: Fungal pathogens like Botrytis cinerea (gray mold) and bacterial soft rot cause decay during storage and transport, particularly at 0–2°C and 95–100% relative humidity.

- Moisture Loss: Lettuce’s high water content makes it prone to wilting and loss of crispness, reducing shelf life, especially for romaine and leaf varieties.

- Physiological Disorders: Russet spotting, brown stain, and tipburn, caused by ethylene exposure, high CO2 levels, or temperature fluctuations, lead to discoloration and reduced marketability.

- Handling Damage: Rough handling during harvest, sorting, or packing causes bruising and shatter, diminishing quality.

These issues necessitate rapid cooling, controlled atmosphere storage (0–2°C, 95–100% RH), and adherence to strict food safety standards, such as those enforced by the Arizona Leafy Greens Marketing Agreement (LGMA), yet inefficiencies persist.

- Environmental and Regulatory Pressures

Arizona’s arid climate, exacerbated by climate change, poses risks through heatwaves, droughts, and reduced water availability. Regulatory costs have surged, with compliance expenses increasing 63.7% from 2017 to 2024, reaching $1,600 per acre. Pesticide restrictions, such as those on neonicotinoids and pyrethroids, are projected to reduce lettuce production by 7.3%, costing producers $160.3 million and consumers $694.28 million annually. Pests like aphids and thrips, reported at the 2024 Yuma Lettuce Insect Losses Workshop, further challenge yields. The industry is adopting sustainable practices, with organic farming contributing to Arizona’s share of the $11.8 billion U.S. organic market in 2023. - Labor and Operational Dynamics

Lettuce production is labor-intensive, with Yuma County employing 30,000–40,000 farmworkers annually for planting, weeding, and harvesting. Post-harvest operations, including sorting, packing, and cooling, require precision to minimize damage. The Arizona LGMA ensures strict food safety standards, but labor shortages, rising costs, and cooling delays increase waste and operational expenses. In 2024, growers focused on mechanization and efficient packing to offset these challenges.

Aloecoat: Transforming Post-Harvest Lettuce Management

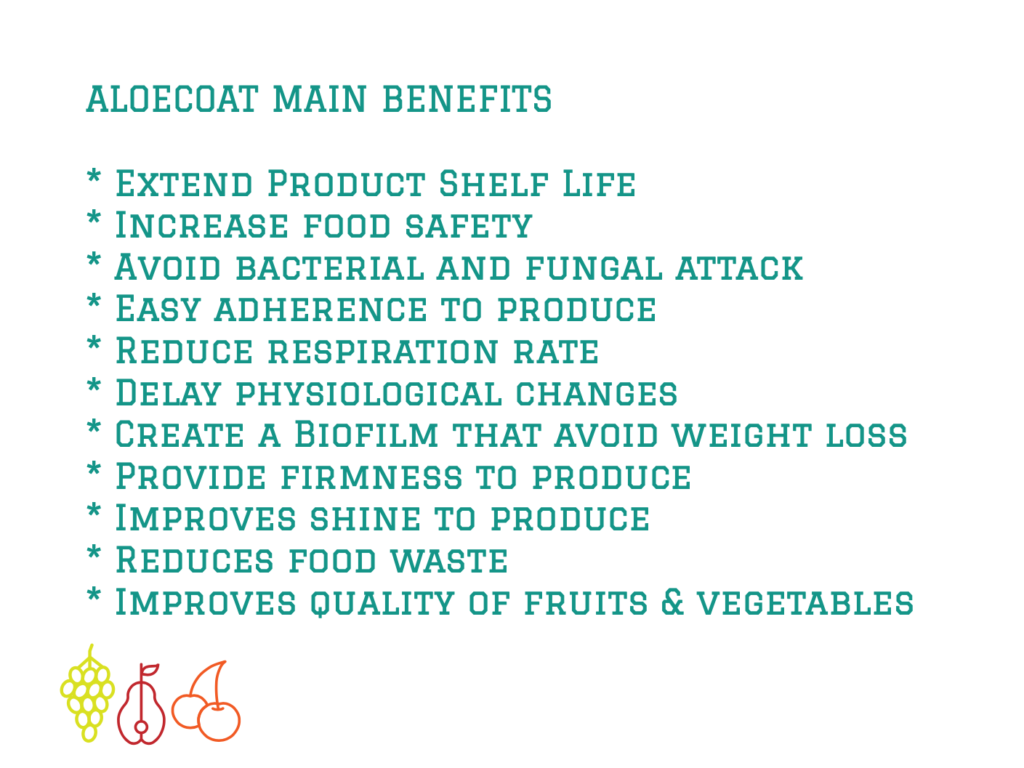

Aloecoat, a biodegradable, edible coating made from aloe vera’s polysaccharides, enzymes, and bioactive compounds, forms a protective biofilm on lettuce, reducing respiration, moisture loss, and microbial growth. This innovative solution addresses Arizona’s lettuce industry challenges, enhancing sustainability and profitability. Here’s how Aloecoat can make a difference:

- Reducing Post-Harvest Waste

- Moisture Retention: Aloecoat’s polysaccharide-based coating minimizes water loss, preserving lettuce crispness and preventing wilting, particularly for high-water-content varieties like romaine and leaf lettuce. This reduces losses from shriveling and maintains marketability beyond the typical 2–3-week shelf life.

- Microbial Control: Aloe vera’s anthraquinones (e.g., aloin) provide natural antimicrobial properties, inhibiting pathogens like Botrytis cinerea and bacterial soft rot, reducing spoilage during storage and transport at 0–2°C.

- Physiological Disorder Prevention: By regulating ethylene exposure and stabilizing cellular integrity, Aloecoat mitigates disorders like russet spotting and tipburn, ensuring visual appeal and quality for retail markets.

- Handling Damage Protection: Aloecoat’s protective layer minimizes bruising and shatter from handling, preserving lettuce integrity for domestic and export markets.

- Extending Shelf Life

Aloecoat slows respiration rates (10–20 ml CO2/kg·hr at 0°C) and ethylene production, extending shelf life under optimal storage conditions (0–2°C, 95–100% RH). This supports Arizona’s role in supplying 25% of U.S. lettuce and exporting to Canada, contributing to the state’s $5.24 billion agricultural economy in 2022. - Enhancing Sustainability

As a non-toxic, plant-based coating, Aloecoat aligns with Arizona’s sustainability goals and consumer demand for clean-label products. It reduces reliance on synthetic fungicides, supporting organic farming and the Arizona LGMA’s food safety standards. By minimizing waste, Aloecoat enhances environmental stewardship and market competitiveness, aligning with the $11.8 billion U.S. organic market in 2023. - Improving Operational Efficiency

- Simplified Handling: Aloecoat’s application (via dipping or spraying) integrates seamlessly into existing packing lines, reducing labor-intensive sorting or trimming of damaged leaves.

- Cost Reduction: By minimizing waste (up to 45% in some cases), Aloecoat lowers losses from unsellable product and reduces equipment maintenance costs due to microbial buildup in storage systems.

- Market Advantage: High-quality, longer-lasting lettuce strengthens Arizona’s position in domestic and international markets, supporting the $934 million industry in 2023 and boosting grower profitability.

- Climate Resilience

Aloecoat mitigates climate-related challenges by protecting lettuce from heat-induced quality degradation and environmental stressors. Its antioxidant properties, derived from aloe vera’s phenolic compounds, preserve flavor, texture, and nutritional value, ensuring premium quality despite drought or heatwaves, which impacted yields in 2024.

The Future of Arizona’s Lettuce Industry with Aloecoat

Arizona’s lettuce industry, valued at $934 million in 2023, is a vital component of the state’s $5.24 billion agricultural economy, but faces challenges from post-harvest losses, climate pressures, and rising regulatory costs.

By integrating Aloecoat into post-harvest protocols, growers can address spoilage, meet consumer demand for sustainable products, and maintain Arizona’s leadership as the “Winter Lettuce Capital of the World.”

At aloegel.biz, we are committed to advancing sustainable agriculture with innovative aloe-based solutions.