Enhancing California’s Berry Industry with Aloecoat: A Sustainable Post-Harvest Solution

California dominates U.S. berry production, supplying over 90% of the nation’s strawberries, significant shares of raspberries, blackberries, and blueberries, with an industry valued at over $3.5 billion in 2023.

Thriving in regions like the Central Coast, Central Valley, and Southern California, the berry sector faces post-harvest challenges such as spoilage, physical damage, and environmental pressures, contributing to waste rates as high as 45% for strawberries.

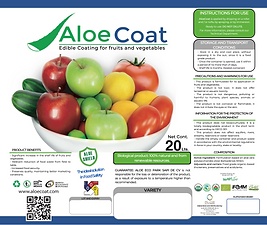

Aloecoat, a 100% natural, plant-based edible coating derived from aloe vera, offers a transformative post-harvest solution to reduce fruit waste, extend shelf life, and optimize industry operations.

This article explores the key characteristics of California’s berry production, leveraging the latest 2023–2024 data, and demonstrates how Aloecoat can elevate sustainability and profitability.

Characteristics of Berry Production in California

- Economic Significance and Production Volume

California’s berry industry is a powerhouse, with strawberries leading as the state’s top berry crop. In 2023, California produced 1.8 million short tons of strawberries across 16,303 hectares (approximately 40,300 acres), generating over $3 billion at the farm-gate. Blueberries are gaining prominence. Raspberries and blackberries, primarily grown in Santa Cruz, Monterey, and San Benito counties, contributed significantly, with fresh-market raspberries valued at millions annually. In 2023, the U.S. exported $1.44 billion in fresh berries, with California leading exports to markets like Canada and Mexico. - Regional and Seasonal Dynamics

Berry production is concentrated in three key regions:- Central Coast (Oxnard, Santa Maria, Watsonville-Salinas): The primary hub for strawberries, producing over 90% of U.S. supply, with harvests peaking from April to October. Blueberries and raspberries also thrive here due to cool coastal climates.

- Central Valley (Fresno, San Joaquin): Supports strawberry and blueberry production, with harvests aligning with warmer inland conditions.

- Southern California (San Diego, Imperial): A hotspot for early-season blueberries, benefiting from mild winters and early spring warmth.

The growing season varies by berry type, with strawberries harvested year-round (peaking in spring/summer), blueberries from April to June, and raspberries/blackberries in summer (larger) and fall (smaller) cycles. In 2024, favorable spring conditions boosted planting, but high summer temperatures slightly reduced yields.

- Climatic and Soil Requirements

Berries require specific conditions: strawberries thrive in well-drained, sandy-loam soils with a pH of 5.5–6.5, while blueberries need acidic soils (pH 4.5–5.5). California’s diverse microclimates, from coastal fog to inland heat, support varied berry cultivation. Drip irrigation and high tunnels are widely used to manage water scarcity, with 2023 reservoir levels at 120% of historical averages providing relief, though 2024’s potential La Niña raised concerns about water allocations. Sustainable practices, including organic farming, are growing, with organic berry sales contributing to California’s $11.8 billion organic market in 2023. - Post-Harvest Challenges

Berries are highly perishable, with post-harvest losses reaching up to 45% for strawberries due to:- Microbial Spoilage: Fungal pathogens like Botrytis cinerea (gray mold) and bacterial soft rot cause decay during storage and transport, particularly at 0–2°C and 90–95% relative humidity.

- Moisture Loss: Water loss (as low as 2–3% for strawberries) leads to shriveling and loss of firmness, reducing marketability.

- Physical Damage: Bruising and crushing from rough handling or over-maturity cause significant waste, especially for soft-skinned berries like raspberries.

- Pest Damage: Spotted-wing drosophila (Drosophila suzukii), a pest detected in California in 2008, infests berries, rendering them unmarketable by laying eggs in ripening fruit.

These challenges require rapid cooling, controlled atmosphere storage, and careful handling, but inefficiencies increase waste and costs.

- Environmental and Regulatory Pressures

Climate change poses risks, including heatwaves, droughts, and wildfires, which impacted yields in 2024. Regulatory costs have surged, with compliance expenses rising 63.7% from 2017 to 2024, reaching $1,600 per acre. Pesticide restrictions, such as those on neonicotinoids, increase pest management costs, while Drosophila suzukii remains a significant threat, causing economic losses in raspberries and blueberries. The industry is adopting sustainable practices, like organic farming and water-efficient irrigation, to align with environmental standards and consumer demand. - Labor and Operational Dynamics

Berry production is labor-intensive, employing 50,000–60,000 workers annually for strawberry harvest alone. Manual harvesting, sorting, and packing are critical, but labor shortages and rising costs strain operations. Post-harvest processes, including rapid cooling and packaging, demand precision to minimize damage. In 2024, growers focused on mechanization and efficient packing to offset reduced acreage and labor challenges.

Aloecoat: Transforming Post-Harvest Berry ManagementAloecoat, a biodegradable, edible coating made from aloe vera’s polysaccharides, enzymes, and bioactive compounds, forms a protective biofilm on berries, reducing respiration, moisture loss, and microbial growth. This innovative solution addresses California’s berry industry challenges, enhancing sustainability and profitability. Here’s how Aloecoat can make a difference:

- Reducing Post-Harvest Waste

- Moisture Retention: Aloecoat’s polysaccharide-based coating minimizes water loss, preserving berry firmness and preventing shriveling, especially for delicate fruits like raspberries and strawberries. This reduces losses from quality degradation, maintaining marketability beyond the typical 2–3-week shelf life.

- Microbial Control: Aloe vera’s anthraquinones (e.g., aloin) provide natural antimicrobial properties, inhibiting pathogens like Botrytis cinerea and bacterial soft rot, reducing spoilage during storage and transport at 0–2°C.

- Physical Damage Protection: Aloecoat’s protective layer minimizes bruising and crushing from handling, preserving berry integrity for fresh and export markets.

- Pest Damage Mitigation: By creating a barrier, Aloecoat reduces the appeal of berries to pests like Drosophila suzukii, complementing integrated pest management strategies.

- Extending Shelf Life

Aloecoat slows respiration rates (e.g., 10–20 ml CO2/kg·hr for strawberries at 0°C) and ethylene production, extending shelf life under optimal storage conditions (0–2°C, 90–95% RH). This supports California’s $1.44 billion berry export market in 2023, enabling longer transport periods to global markets like Canada and Mexico. - Enhancing Sustainability

As a non-toxic, plant-based coating, Aloecoat aligns with California’s sustainability goals and consumer demand for clean-label products. It reduces reliance on synthetic fungicides, supporting organic farming, which contributed $11.8 billion to California’s agricultural economy in 2023. By minimizing waste, Aloecoat enhances environmental stewardship and market competitiveness. - Improving Operational Efficiency

- Simplified Handling: Aloecoat’s application (via dipping or spraying) integrates seamlessly into existing packing lines, reducing labor-intensive sorting or trimming of damaged berries.

- Cost Reduction: By minimizing waste (up to 45% for strawberries), Aloecoat lowers losses from unsellable product and reduces equipment maintenance costs due to microbial buildup in storage systems.

- Market Advantage: High-quality, longer-lasting berries strengthen California’s position in global markets, supporting the $3.5 billion industry and boosting grower profitability.

- Climate Resilience

Aloecoat mitigates climate-related challenges by protecting berries from heat-induced quality degradation and environmental stressors. Its antioxidant properties, derived from aloe vera’s phenolic compounds, preserve flavor, texture, and nutritional value, ensuring premium quality despite heatwaves or drought, which impacted yields in 2024.

The Future of California’s Berry Industry with Aloecoat

California’s berry industry, valued at over $3.5 billion in 2023, navigates a complex landscape of climate challenges, regulatory pressures, and post-harvest losses. Aloecoat offers a cutting-edge solution, leveraging aloe vera’s natural properties to reduce waste, extend shelf life, and enhance operational efficiency.

By integrating Aloecoat into post-harvest protocols, growers can address spoilage, meet consumer demand for sustainable products, and maintain California’s leadership in the global berry market.

At aloegel.biz, we are committed to advancing sustainable agriculture with innovative aloe-based solutions.